It’s that time of year again when Daylights Savings ends, and we “fall back” and gain an hour of sleep. While gaining an hour of sleep may seem enjoyable, research has shown that it can have adverse health consequences, including sleep disruption, mood disturbances, and even an increased risk of fatal accidents. This biannual event takes a toll on our bodies, leaving us tired, disturbing our sleep, and even increasing the chance of workplace injuries, strokes, and heart attacks.

According to a 2020 study by the National Institute of Health found that around 550,000 Americans experienced physical health problems caused by these time changes.

While drowsy driving may increase with the springtime change, concerns for driver safety also arise with the fall time shift. In the fall and winter, many individuals find it difficult to get used to the sun setting considerably earlier in the day. As a result, even though the sun is setting or it is already dark outside, people may still be outside in the late afternoon and early evening, increasing the risk of pedestrian accidents due to poor light conditions. And that’s on top of all the other dangers of driving at night. Drivers may find it challenging to see due to glare at times of day when they are not accustomed to it due to variations in dawn and sunset.

How to Adjust to the Time Change

Employers and employees alike should be aware of the dangers of working after Daylight Savings and take steps to stay safe on the job. It can take the body up to a week to adjust sleep times and circadian rhythms to the time change. During this time, it is important to:

- Get as much rest as possible

- Avoid alcohol and caffeine

- Employers should also be aware of the signs that an employee struggles to adjust. This includes changes in sleep patterns, mood swings, and decreased productivity.

Contact a Workers’ Compensation Lawyer Today

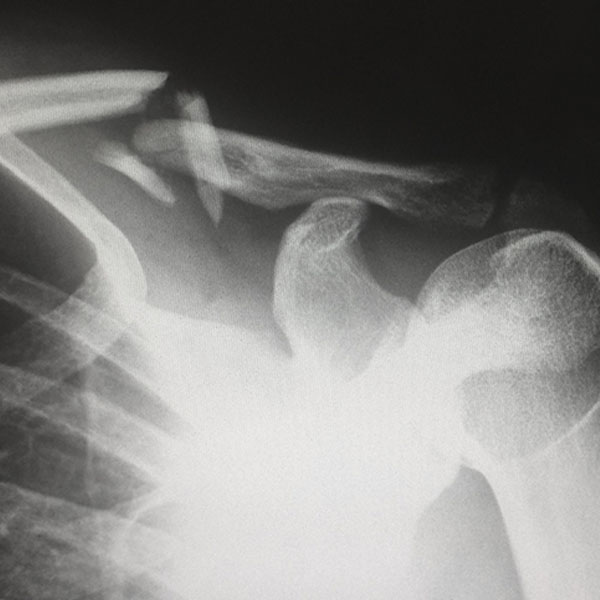

If you are injured on the job after Daylight Savings, it is important to be familiar with North Carolina workers’ compensation law. Workers’ compensation provides benefits to employees who are injured or become ill due to their job.

Workers’ compensation benefits can help cover medical benefits, including medical bills related to the injury, wage replacement benefits, and other costs associated with your injury. In North Carolina, workers’ compensation covers most injuries that occur at work. This includes accidents, illnesses, and repetitive stress injuries.

If you or someone you love has suffered a job-related injury or illness, call an experienced workers’ compensation lawyer at Collier Law for assistance with your workers’ comp case.

You are so much more than a number to us: we value our attorney-client relationship and getting the justice you deserve. We are advocates for injured employees. Call for a free consultation to find out how we may assist you.